A drug formulary is a list of prescription medications that your health insurance plan agrees to cover. It’s not just a catalog-it’s a tool that decides which drugs you can get at a low cost, which ones will cost you more, and which ones your plan won’t pay for at all. If you’ve ever been surprised by a high pharmacy bill or told your doctor you can’t fill a prescription because it’s "not covered," you’ve run into the real-world impact of a formulary.

How Drug Formularies Work

Every health plan-whether it’s Medicare Part D, Medicaid, or a private insurance plan-uses a formulary to control costs and guide treatment. These lists aren’t random. They’re created by teams of doctors, pharmacists, and health experts called Pharmacy and Therapeutics (P&T) committees. These groups review clinical studies, safety data, and real-world outcomes to pick the drugs that work best and offer the most value.

But here’s the catch: just because a drug works doesn’t mean it’s on the list. If a cheaper generic version exists, or if a similar drug has proven just as effective at a lower price, the formulary will favor that one. This isn’t about denying care-it’s about making sure your plan pays for medications that deliver results without unnecessary spending.

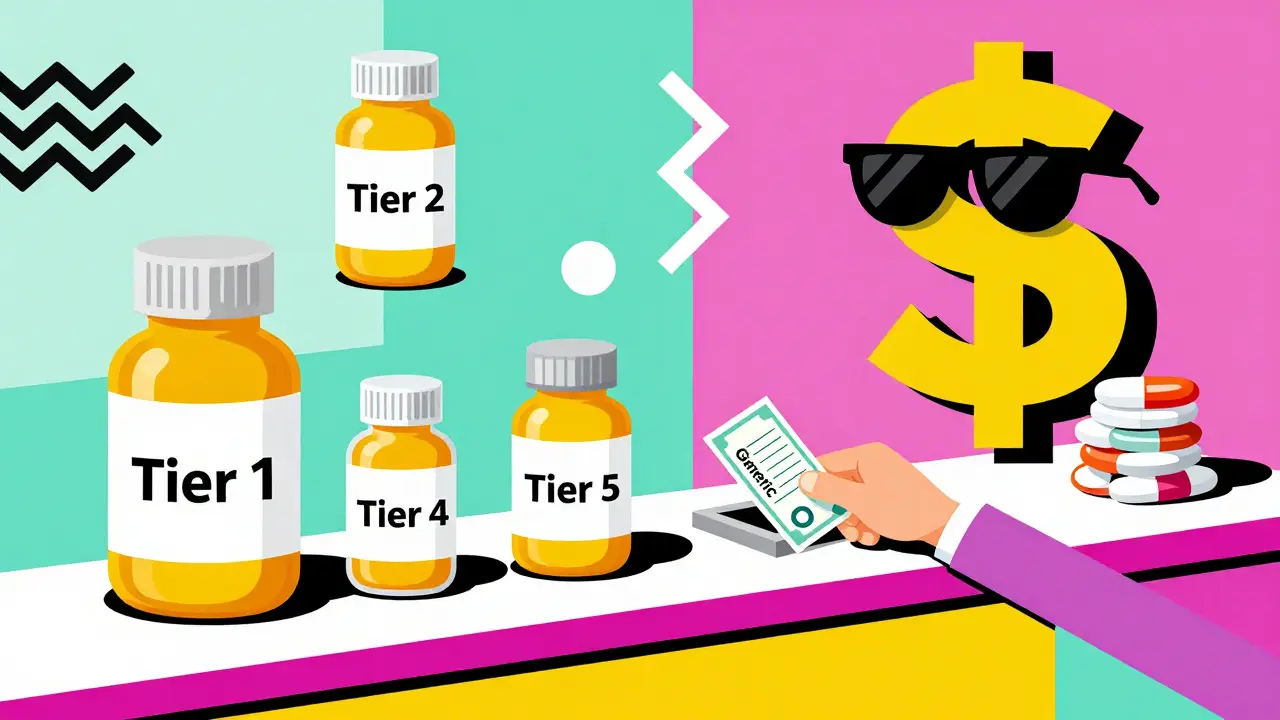

The Tier System: What You Pay Depends on the Tier

Most formularies are broken into tiers. Each tier has a different cost to you. The higher the tier, the more you pay. Here’s how it usually breaks down:

- Tier 1: Generic Drugs - These are the cheapest. They’re chemically identical to brand-name drugs but cost a fraction of the price. You might pay $0 to $10 for a 30-day supply.

- Tier 2: Preferred Brand-Name Drugs - These are brand-name medications that your plan has negotiated a good deal on. Expect to pay $25 to $50 per prescription.

- Tier 3: Non-Preferred Brand-Name Drugs - These are brand-name drugs without a good price deal. You’ll pay more-often $50 to $100 per prescription.

- Tier 4: Specialty Drugs - These are high-cost medications for complex conditions like cancer, MS, or rheumatoid arthritis. Copays can be $100 or more, and you might pay 30% to 50% of the total cost as coinsurance.

- Tier 5 (if applicable): Ultra-Specialty Drugs - Some plans have a fifth tier for the most expensive treatments, sometimes costing thousands per month.

For example, a diabetes pill like metformin (a generic) might be Tier 1 and cost $5. But if your doctor prescribes a newer, brand-name version, it could jump to Tier 3 and cost $85. That’s why checking your formulary before filling a prescription matters.

Why Your Drug Might Not Be Covered

Not every medication makes it onto a formulary. If your doctor prescribes a drug that’s not listed, you’ll likely face one of three outcomes:

- You pay full price out of pocket-sometimes hundreds or even thousands of dollars.

- Your plan denies coverage entirely.

- You’re asked to try another drug first.

The last one is called step therapy. It means your plan requires you to try a cheaper, approved drug before letting you use the one your doctor picked. For instance, if your doctor prescribes a new biologic for arthritis, your plan might make you try two older, less expensive drugs first. If those don’t work, you can request an exception.

Another common restriction is prior authorization. This means your doctor has to call or submit paperwork to prove why you need that specific drug before the plan will cover it. It’s not a denial-it’s a delay. But if your condition is urgent, you can ask for an expedited review.

Formularies Change-All the Time

Don’t assume your drug will stay on the same tier next year. Formularies are updated regularly. A drug might move from Tier 2 to Tier 3 if a cheaper alternative becomes available. Or a drug could be removed entirely if safety concerns arise.

Medicare Part D plans must update their formularies by January 1 each year, and they’re required to give you 60 days’ notice if a drug you’re taking is being removed or moved to a higher tier. Private plans follow similar rules.

That’s why checking your formulary every year during open enrollment is critical. If you’re on Medicare, use the Medicare Plan Finder tool in October to compare plans and see which one covers your medications best. For private insurance, log into your plan’s website and search for "formulary" or "preferred drug list."

What If Your Drug Isn’t on the List?

You’re not stuck. You can ask for a formulary exception. This is a formal request-usually started by your doctor-to get your plan to cover a drug that’s not on the list.

Your doctor needs to write a letter explaining why the preferred drugs won’t work for you. Maybe you had bad side effects. Maybe you’ve tried them before and they failed. Maybe your condition is too complex for the alternatives. The plan has to respond within 72 hours for a standard request, or 24 hours if it’s an emergency.

In 2023, about 67% of these exceptions were approved for Medicare Part D plans. That means if your doctor makes a strong case, you have a good shot.

Real Patient Stories

One patient, Maria, had been taking a brand-name blood pressure medication for years. Her Medicare plan moved it from Tier 2 to Tier 3. Her monthly cost jumped from $30 to $90. She couldn’t afford it. Her doctor switched her to a generic version on Tier 1-same effectiveness, $12 a month. She saved $900 a year.

Another patient, James, needed a specialty drug for multiple sclerosis. It cost $8,000 per month without insurance. His plan covered it on Tier 4 with a $120 copay. Without the formulary, he’d have been forced to choose between his health and his rent.

But not everyone is so lucky. A 2023 survey found that 31% of insured patients had a prescription denied because it wasn’t on their formulary. Many felt confused, frustrated, or even abandoned.

New Rules in 2024-2025

Things are changing to help patients. Starting in 2023, Medicare capped insulin at $35 per month. In 2025, there will be a $2,000 annual cap on out-of-pocket drug costs for all Medicare Part D beneficiaries.

Also in 2024, every new Medicare Part D enrollee gets a free one-on-one session with a pharmacist to help them understand their formulary. And with more biosimilars (lower-cost versions of biologic drugs) being approved, formularies are starting to include more affordable alternatives for conditions like arthritis and Crohn’s disease.

How to Protect Yourself

Here’s what you can do right now:

- Always check your formulary before your doctor writes a prescription. Ask: "Is this on my plan’s list? What tier is it?"

- Keep a printed or digital copy of your current formulary. Save it on your phone.

- During open enrollment (October 15-December 7 for Medicare), compare plans based on your medications-not just premiums.

- If a drug is removed or moved to a higher tier, contact your plan immediately. You might be able to get a 30- to 90-day transition supply.

- Don’t be afraid to ask for an exception. Your doctor’s support makes all the difference.

Remember: formularies aren’t designed to hurt you. They’re designed to keep costs down so more people can get the medicines they need. But they only work if you understand them-and speak up when they don’t fit your needs.

What is a drug formulary?

A drug formulary is a list of prescription medications that your health insurance plan covers. It’s organized into tiers that determine how much you pay out of pocket. The plan chooses which drugs to include based on safety, effectiveness, and cost. Not all medications are on the list, and some require special approval before coverage.

Why does my insurance not cover my medication?

Your medication may not be on your plan’s formulary, meaning it wasn’t selected for coverage due to cost or availability of alternatives. It could also be subject to restrictions like prior authorization or step therapy. If your doctor believes the drug is medically necessary, you can request a formulary exception.

How do I find out if my drug is covered?

Log in to your insurance plan’s website and search for "formulary" or "preferred drug list." You can also call customer service or ask your pharmacist. For Medicare beneficiaries, use the Medicare Plan Finder tool to compare formularies across plans.

Can my drug be removed from the formulary?

Yes. Plans can remove drugs or move them to higher tiers at any time, but they must give you 60 days’ notice. If your drug is removed, you may qualify for a temporary transition supply while you and your doctor find an alternative or request an exception.

What is step therapy?

Step therapy means your plan requires you to try one or more lower-cost, approved drugs before covering the one your doctor prescribed. If those don’t work or cause side effects, you can request an exception to skip the steps and get your preferred medication.

Do all insurance plans have the same formulary?

No. Every plan creates its own formulary. A drug that’s on Tier 2 in one plan might be on Tier 4 in another-or not covered at all. That’s why comparing formularies during open enrollment is essential, especially if you take multiple medications.

What’s the difference between a generic and a brand-name drug on a formulary?

Generic drugs are chemically identical to brand-name drugs and are usually placed on Tier 1 for the lowest cost. Brand-name drugs are often on Tier 2 or higher and cost more. Formularies favor generics because they’re proven to work just as well at a fraction of the price.

Are there any drugs that must be covered by law?

Yes. Medicare Part D plans must cover at least two drugs in each major therapeutic category. Also, under the Inflation Reduction Act, all Medicare Part D plans must cap insulin at $35 per month and will cap total out-of-pocket drug costs at $2,000 per year starting in 2025.

What to Do Next

Don’t wait until you’re at the pharmacy counter to find out your drug isn’t covered. Take 10 minutes today to look up your formulary. Know what your medications cost, what alternatives exist, and what to do if something changes. If you’re on Medicare, use the Plan Finder. If you have private insurance, log in to your portal. Talk to your pharmacist-they know the formulary inside and out.

Formularies aren’t perfect. But when you understand them, you turn them from a mystery into a tool that works for you-not against you.

January 3, 2026 AT 20:18 PM

Just checked my formulary today-metformin’s still Tier 1. Saved me $80/month. Small wins matter.

Always ask your pharmacist. They know the loopholes.

January 4, 2026 AT 09:41 AM

Formularies are corporate gatekeeping dressed up as cost control. They don’t care if you’re stable on a drug-they care if it’s profitable to keep it on the list.

It’s not medicine. It’s a balance sheet with a stethoscope.

And don’t get me started on how they force step therapy like it’s a game of musical chairs with your health.

January 5, 2026 AT 17:55 PM

Ugh, I just went through this with my MS med 😩

They moved it to Tier 4 and I cried in the pharmacy aisle.

Thank god my doc fought for the exception-got approved in 48 hours.

Formularies suck, but you CAN win. Just don’t give up.

And yes, I’m still mad. 🤬

January 6, 2026 AT 20:14 PM

From a clinical pharmacoeconomics standpoint, formularies are a rational application of incremental cost-effectiveness ratios (ICERs) to optimize population-level outcomes while constraining budgetary exposure.

But the operational reality? It’s a bureaucratic minefield.

P&T committees operate under opaque criteria, often influenced by rebate structures rather than pure clinical efficacy.

Step therapy violates the principle of clinical autonomy, and prior auth delays are de facto denial mechanisms.

And yet-without tiering, we’d see even higher premiums. It’s a tragic optimization problem.

Patients need better transparency, not just appeals processes.

And yes, biosimilars are the future-but we’re still years away from equitable access.

January 8, 2026 AT 18:46 PM

Interesting article. Very thorough.

But… have you considered how formularies disproportionately impact rural patients?

Not everyone has a pharmacist who can advocate for them.

And the 60-day notice? Meaningless if you’re on a 90-day supply and your doctor’s 70 miles away.

Also-why is insulin capped but not glaucoma meds?

It’s not logic. It’s politics.

And yes, I’m a Brit. I’ve seen the NHS. This is… chaotic.

January 9, 2026 AT 04:10 AM

Oh please. You’re telling people to "check their formulary" like it’s a Yelp review?

Most patients don’t know what a P&T committee is.

And let’s be real-this whole system exists to make Big Pharma rich while pretending they’re saving money.

Those "affordable" generics? They’re often manufactured in India with sketchy oversight.

And don’t get me started on how insurers pressure doctors to prescribe the cheapest, not the best.

This isn’t healthcare. It’s a corporate shell game.

And you’re acting like it’s normal.

It’s not.

It’s cruel.

And you’re complicit if you don’t scream about it.

January 10, 2026 AT 10:31 AM

Let’s be precise: the term "formulary" is a euphemism for rationing. The article romanticizes it as a "tool"-it’s a triage mechanism disguised as consumer empowerment.

Patients are not stakeholders. They are cost centers.

Step therapy is unethical. Prior authorization is administrative malpractice.

And the claim that "67% of exceptions are approved" is statistically misleading-it ignores the 33% who die waiting, quit treatment, or go bankrupt.

This is not healthcare reform. It’s cost-shifting with a smiley face.

January 10, 2026 AT 18:40 PM

YOU CAN DO THIS!

Don’t let the system beat you!

Call your insurer. Email your rep. Text your doctor.

Formularies change-but so can you!

Be loud. Be persistent. Be the patient they didn’t expect.

You’ve got this. 💪🔥

And if you need help? DM me. I’ve been there. I’ll walk you through it.

YOU ARE NOT ALONE.

January 11, 2026 AT 09:50 AM

For anyone new to this-here’s the secret: your pharmacist is your best friend.

They see every formulary change before you do.

They know which drugs are about to get kicked off.

They can often switch you to a generic before your script even hits the counter.

Go say hi. Ask questions. Bring a list.

They’re not just dispensing pills-they’re your insurance detectives.

And yes, they’ll help you even if you’re just curious.

Don’t wait until you’re at the counter in panic.

Build that relationship now.

January 12, 2026 AT 05:37 AM

Oh honey, you think this is bad?

Wait till you try getting a specialty drug in South Africa.

We don’t even have formularies here-we have wishlists.

And if you’re lucky? You get a 3-month supply once a year.

So yes, I’m jealous of your tier system.

At least you know what you’re getting denied.

We just get silence.

And your $35 insulin? We pay $150 for the same vial.

But hey, at least you have a system to fight.

We just have hope.

January 12, 2026 AT 07:25 AM

Let’s be honest: the only reason formularies exist is because patients are too lazy to research their own meds.

And now we’re rewarding that ignorance with a 60-day notice?

Wake up.

It’s your responsibility to know what’s covered.

Stop blaming the system.

Start reading the fine print.

And if you can’t? Then maybe you shouldn’t be on 5 different prescriptions.

It’s not the insurer’s job to babysit you.

It’s yours.

January 14, 2026 AT 05:12 AM

Formularies are like Spotify playlists for medicine.

Some songs (drugs) get promoted because the label (pharma) paid for placement.

Others? Buried. Even if they’re bangers.

And the tiers? That’s just the algorithm deciding what you "deserve" based on how much you pay.

But here’s the twist-sometimes the hidden gem (generic) is the best track.

Metformin? Pure banger.

Brand-name insulin? Overproduced, overpriced, overhyped.

Trust the algorithm… sometimes.

But always check the credits.

January 15, 2026 AT 00:00 AM

My formulary changed last month. My RA med got moved to Tier 4. My copay went from $45 to $210.

My doctor submitted the exception.

It was denied.

They said "alternative therapies exist."

They listed two drugs I’ve been on since 2018.

One gave me liver failure.

The other made me hallucinate.

So now I’m choosing between pain and psychosis.

And the system says I’m "informed."

Yeah. Right.

January 16, 2026 AT 13:17 PM

Thank you for this. I am from Nigeria. We have no formulary.

People die because they cannot afford one pill.

Here, at least you have tiers.

Here, you can fight.

Here, you have a letter.

Where I am, there is only silence.

So I read this and I am grateful.

Even if it is broken, it is better than nothing.

Thank you.

🙏

January 17, 2026 AT 23:59 PM

Oh wow. A whole article about how to navigate a system designed to make you feel like a burden.

And the solution? "Ask your doctor!"

Yeah, because doctors have nothing better to do than write appeals while their EMR crashes and their patients wait 3 hours.

And the real kicker? You’re telling people to "check their formulary" like it’s a Netflix catalog.

Meanwhile, the average patient has 3 chronic conditions, works two jobs, and can’t afford childcare.

Thanks for the pep talk, Oprah.

Now go fix the system.

January 18, 2026 AT 10:44 AM

Formularies? Yeah, they’re fine.

My cousin’s on Medicare and she just got her insulin for $35.

So it’s all good.

Wait-what’s step therapy?

Oh. Hmm.

Anyway, I’m sure it’s all fine.

Probably just lazy people who don’t read.

Also, I think generics are just placebo pills.

Just kidding. Maybe.

😂

January 18, 2026 AT 18:57 PM

FORMULARIES ARE A GREYHOUND TRACK FOR PHARMA DOGS.

They run the same drugs over and over until you’re broke.

And the "exceptions"? That’s just the system letting you beg for mercy.

And don’t tell me about biosimilars-they’re clones made in labs that don’t follow FDA rules.

And insulin is capped? Only because the public screamed.

Next up: they’ll cap your oxygen.

And your EpiPen.

And your heart meds.

They’re coming for your life.

And they’ll call it "affordability."

🚨🇺🇸

January 19, 2026 AT 04:37 AM

Man, I used to work in pharmacy. Saw this every day.

Old lady crying because her blood pressure med got yanked.

Teen with asthma who couldn’t afford his inhaler.

Guys choosing between insulin and rent.

Yeah, formularies are a tool.

But the tool’s broken.

And the people who designed it? They don’t live with the consequences.

So yeah. Check your list.

But also? Get mad.

And vote.

And tell your story.

They don’t care until you make them.

January 19, 2026 AT 10:29 AM

Why do people act like formularies are new?

They’ve existed since the 80s.

And guess what? The system worked fine until everyone started demanding brand-name everything.

Now we’re paying for it.

And instead of taking responsibility, we blame the insurance company.

It’s not a conspiracy.

It’s economics.

And if you want cheaper meds?

Stop demanding the most expensive option.

And stop acting like your doctor’s opinion overrides science.

Formularies exist because you demanded it.

Now deal with it.

And stop crying about it.