When a hospital decides to add a new generic drug to its formulary, it’s not just a purchasing decision. It’s a clinical, financial, and operational puzzle that involves pharmacists, physicians, administrators, and sometimes even patients. The hospital formulary isn’t a static list you update once a year-it’s a living system that balances safety, effectiveness, and cost every single day.

What Is a Hospital Formulary, Really?

A hospital formulary is a curated list of medications approved for use within a specific healthcare institution. Unlike retail pharmacies, where patients pick from a broad selection, hospitals use closed or partially closed formularies to tightly control what drugs are available. Most hospitals keep between 300 and 1,000 drug products on their formulary. These aren’t chosen by the pharmacy director alone. They’re selected by a Pharmacy and Therapeutics (P&T) committee-a group of clinicians and pharmacists who meet monthly or quarterly to review new drugs and re-evaluate existing ones. This committee doesn’t just look at price. They demand proof that a generic drug is truly equivalent to the brand-name version. Regulatory approval from the FDA isn’t enough. In critical care settings, even tiny differences in how a drug is absorbed or metabolized can matter. A generic anticoagulant might look identical on paper, but if it causes more frequent lab monitoring or delays in patient discharge, the cost savings disappear.How Generics Are Ranked: The Tier System

Most hospital formularies use a tiered structure to guide prescribing. Think of it like a pricing ladder:- Tier 1: Preferred generics - Lowest cost, lowest patient copay, first-line choice. These are the workhorses of the formulary.

- Tier 2: Non-preferred generics or preferred brands - Slightly higher cost, may require prior authorization.

- Tier 3: Non-preferred brands - More expensive, often used only when generics fail or aren’t suitable.

- Tiers 4-5: Specialty drugs - High-cost, complex medications like biologics or oncology drugs. These often require step therapy or strict monitoring.

The Hidden Costs of Generic Switching

Many hospitals assume switching to a generic drug automatically saves money. But real-world data tells a different story. A 2022 study at Johns Hopkins found that switching from a brand to a generic anticoagulant led to more frequent INR checks, extra nursing time, and longer patient stays. The $5-per-dose savings vanished when you added up the extra labor and monitoring. Complex generics-like inhalers, injectables, or topical creams-are especially tricky. The FDA’s 2022 report showed only 62% of complex generic applications were approved on the first try, compared to 88% for simple pills. Why? Because the delivery system matters. A generic inhaler might contain the same active ingredient, but if the propellant or nozzle design changes, the drug doesn’t reach the lungs the same way. That’s not just a technicality-it’s a clinical risk. And then there’s the supply chain. In Q3 2023, 84% of hospital pharmacists reported at least one critical shortage of a generic drug. When a formulary drug disappears, hospitals scramble to buy non-formulary alternatives-sometimes paying double or triple the price. One hospital in Ohio paid $1,200 per vial of a generic antibiotic when the formulary version was out of stock. The same drug, when available, cost $180.

How P&T Committees Actually Decide

P&T committees don’t rely on gut feelings. They use three core criteria:- Efficacy - Does it work as well as the brand? Clinical studies, real-world outcomes, and therapeutic equivalence data are reviewed.

- Safety - Are there hidden risks? Especially for drugs with narrow therapeutic windows like warfarin, lithium, or phenytoin.

- Cost - Not just the list price. Net cost after rebates, service fees, and contract terms.

Hospital vs. Retail Formularies: Why They’re Not the Same

Medicare Part D plans must include at least two drugs in each of 57 therapeutic categories. Hospitals don’t have that rule. They can-and often do-limit options to one or two drugs per class. Why? Because in a hospital, nurses administer the drugs. Pharmacists monitor for interactions. Patients don’t store pills in their medicine cabinets. This means hospitals can safely be more selective. Retail formularies are built for volume and convenience. Hospital formularies are built for control. They use tools like:- Prior authorization

- Quantity limits

- Step therapy (try generic before brand)

- Automatic substitution alerts in the EHR

What Makes a Generic Selection Program Successful?

Successful hospitals don’t just swap brands for generics. They build programs around them. The Mayo Clinic, for example, saved $1.2 million annually by switching to generics for cardiovascular drugs-but only after setting up:- Therapeutic interchange protocols

- Pharmacist-led monitoring for high-risk drugs

- Regular audits of outcomes and cost data

- P&T committees with at least 50% clinical pharmacists

- Quarterly reviews of new generics within 90 days of FDA approval

- Formal AMCP dossiers for every new submission (clinical data, pharmacology, economic analysis)

- Training for new committee members-onboarding takes 6 to 9 months

The Future: Transparency, Complexity, and Value

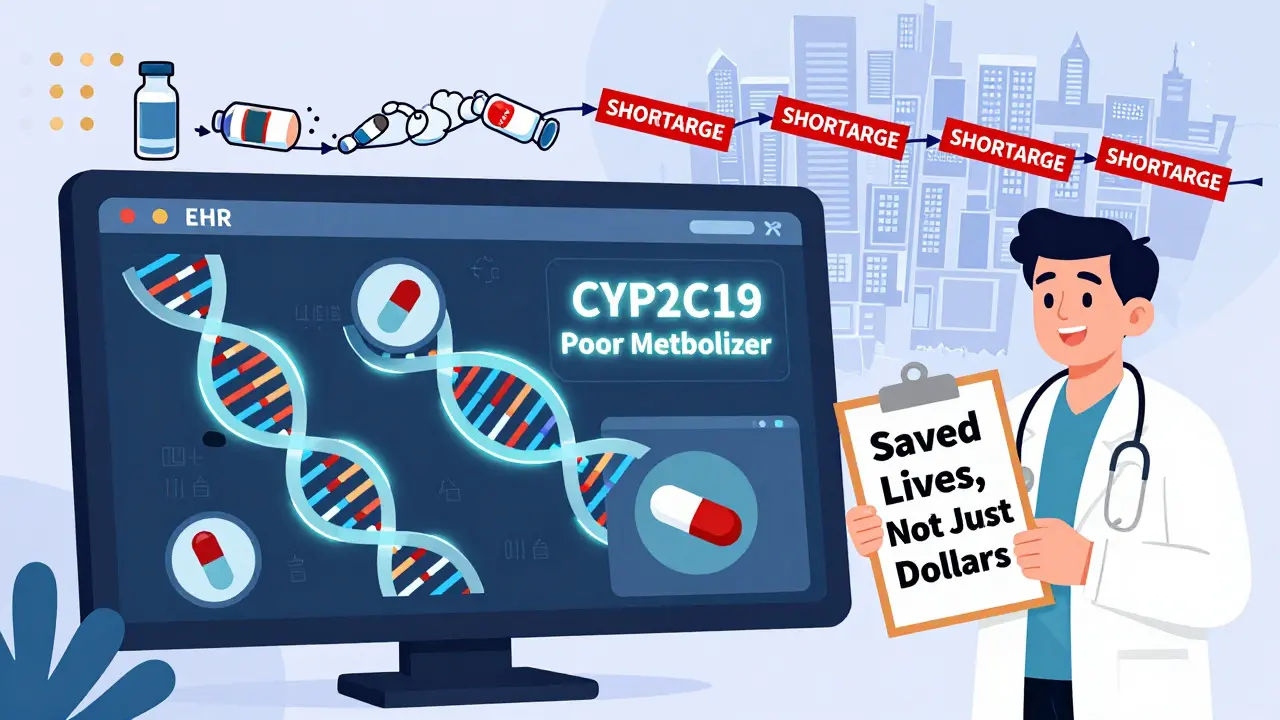

The hospital generic market was worth $42.7 billion in 2022, making up 89% of drug volume-but only 28% of spending. That’s because a few big manufacturers control 58% of the market. When one plant shuts down, shortages ripple across the country. New regulations are changing the game. The 2023 Consolidated Appropriations Act requires drug pricing transparency starting January 2025. Hospitals will finally see what rebates and discounts are really being offered. This could end the era of hidden costs and rebate-driven decisions. Meanwhile, the FDA’s GDUFA III program is investing $4.3 million annually to speed up approval of complex generics. By 2026, we may see more reliable options for injectables and inhalers. And the newest frontier? Pharmacogenomics. Twenty-eight percent of academic medical centers now consider a patient’s genetic profile before choosing a generic drug-especially for drugs like clopidogrel or warfarin, where genetics affect how well they work.Bottom Line: Cost Isn’t the Only Metric

Choosing generics isn’t about picking the cheapest pill on the shelf. It’s about understanding how a drug behaves in a hospital setting-how it’s given, how it’s monitored, how it affects workflow, and how it impacts real patients. The best formularies don’t just save money. They protect safety, reduce waste, and support better care. Hospitals that treat formulary economics like a simple cost-cutting exercise end up paying more-in staff time, patient risk, and supply chain chaos. Those that treat it as a clinical decision-making process don’t just save money-they save lives.What is the main goal of a hospital formulary?

The main goal is to ensure safe, effective, and cost-efficient use of medications within the hospital. It’s not about cutting costs alone-it’s about balancing clinical outcomes, patient safety, and financial sustainability through evidence-based drug selection.

Why don’t hospitals just pick the cheapest generic?

Because the lowest list price doesn’t always mean the lowest net cost. Rebates, service agreements, supply reliability, and hidden costs like extra monitoring or nursing time can make a cheaper generic more expensive overall. Clinical performance matters just as much as price.

How do P&T committees evaluate generic drugs?

They use three core criteria: efficacy (does it work as well as the brand?), safety (are there risks, especially with narrow therapeutic index drugs?), and cost (net cost after rebates and contracts). They also consider ease of use, dosage form, and stability in hospital settings.

What’s the difference between hospital and retail formularies?

Hospital formularies are more restrictive and focus on controlled environments where staff administer drugs. Retail formularies prioritize patient access and convenience. Hospitals can use tools like prior authorization and step therapy more aggressively because they control the entire medication process.

Why are complex generics harder to include in formularies?

Complex generics-like inhalers, injectables, or topical products-require more than just matching the active ingredient. The delivery system, particle size, and formulation must be clinically equivalent. The FDA approves only 62% of complex generic applications on the first try, compared to 88% for simple pills, making them riskier and slower to adopt.

How do drug shortages affect formulary decisions?

When a formulary drug runs out, hospitals are forced to buy non-formulary alternatives, often at 2-3 times the cost. In Q3 2023, 84% of hospitals reported at least one critical generic shortage. This forces constant re-evaluation of backup options and makes supply chain reliability a key factor in drug selection.

Is pharmacogenomics being used in formulary decisions?

Yes. Twenty-eight percent of academic medical centers now consider genetic testing data when choosing generics for drugs with narrow therapeutic indices-like warfarin, clopidogrel, or certain antidepressants. If a patient’s genes make them a poor metabolizer, a generic might not work as well, even if it’s bioequivalent on paper.

January 10, 2026 AT 07:30 AM

This is why I hate when admins think formularies are just about saving pennies. You swap a generic, then suddenly nurses are doing triple the INR checks and patients are stuck for extra days. The math doesn't add up unless you account for labor, not just list price.

January 11, 2026 AT 03:07 AM

I work in a hospital in Mumbai and let me tell you, the generic drug situation here is a nightmare. We get shipments that are either expired or have wrong batch numbers. Sometimes the pill looks different, the color, the imprint-everything. But we have to use it because there's no alternative. No one talks about this. The FDA standards? They don't apply here. We just pray the patient doesn't crash.

January 12, 2026 AT 04:08 AM

I just read this and I'm CRYING 😭😭😭 like WHO thought this was a good idea?? We're literally playing Russian roulette with patients' lives because someone in accounting wanted to cut $0.40 per pill. This isn't healthcare. This is corporate horror fiction. #FormularyFail

January 13, 2026 AT 08:19 AM

The system is broken and everyone knows it. But nobody wants to fix it because the people making the decisions don't have to clean up the mess when a patient has a stroke because the generic warfarin didn't dissolve right.

January 13, 2026 AT 11:34 AM

I've seen this firsthand. A patient on phenytoin was switched to a cheaper generic. Their levels fluctuated wildly. They had a seizure. The hospital lost $80k in ICU charges. The 'savings' were $12.

January 14, 2026 AT 16:16 PM

Ah yes, the classic 'cost savings' delusion. Let me guess-the P&T committee is staffed by accountants with 2 years of pharmacy school and a spreadsheet fetish. No wonder we're still using 2010-era protocols. The FDA approves a drug, and suddenly it's gospel? Please. If it were that simple, we'd all be taking aspirin for everything.

January 15, 2026 AT 23:14 PM

The American healthcare system is collapsing under the weight of its own bureaucratic inertia. We outsource drug manufacturing to countries with zero regulatory oversight, then act shocked when the generics fail. This isn't economics-it's national security failure disguised as budgeting.

January 16, 2026 AT 17:01 PM

In India, we don't have the luxury of tiered formularies. We get what's available. And if it's not on the list, we use it anyway. The real issue is supply chain, not cost.

January 18, 2026 AT 12:25 PM

Let’s not pretend this is about patient care. It’s about rebate maximization. A drug with a $100 list price but a 70% rebate beats a $50 drug with no rebate every time. The P&T committee? Just a rubber stamp for pharma sales reps with Excel decks. 🤡

January 20, 2026 AT 09:13 AM

There’s a deeper question here: Is healthcare a market or a covenant? If it’s a market, then yes, optimize for cost. But if it’s a covenant-something we owe to the vulnerable-then we must optimize for trust. And right now, the system is eroding trust faster than it’s saving dollars.

January 21, 2026 AT 10:24 AM

I’ve been in this game for 18 years and I’ve never seen a hospital that actually does this right. The Mayo and Cleveland examples? Those are the exceptions. Most places have a P&T committee that meets once a quarter, spends 20 minutes on each drug, and votes based on who yelled loudest. The rest is just paperwork. We’re not saving money-we’re just hiding the cost in overtime and readmissions.

January 21, 2026 AT 13:24 PM

The truth? We don’t need more committees. We need fewer drugs. One per class. Period. If a drug is good enough to be in the formulary, it’s good enough to be the only one. Stop the chaos. Stop the switching. Stop pretending we’re clinical when we’re just cost-obsessed bureaucrats.

January 22, 2026 AT 20:20 PM

You say pharmacogenomics is the future? That’s cute. Most hospitals can’t even get their EHR to auto-flag drug interactions. You’re talking about sequencing patients’ DNA while half the nurses still use paper med sheets. This isn’t innovation-it’s fantasy dressed in jargon.

January 24, 2026 AT 08:44 AM

I’ve mentored new pharmacists through this mess. The key isn’t the tier system-it’s the culture. If you treat formulary decisions like a clinical decision, not a procurement task, everything changes. Train your team to ask: 'Would I give this to my mom?' If the answer isn’t yes, don’t add it.

January 24, 2026 AT 12:30 PM

I know this sounds idealistic, but hear me out-what if we stopped measuring success by dollars saved and started measuring it by lives improved? I’ve seen hospitals cut costs and then see their mortality rates creep up. The money didn’t disappear-it just moved to the funeral home. We need to change the metric. Not the drug.

January 26, 2026 AT 04:41 AM

You call this 'evidence-based'? Please. The 'evidence' is the spreadsheet that says 'cheaper = better.' Real evidence is the 72-year-old woman who had a GI bleed because the generic clopidogrel didn't dissolve right. But no one audits that. Because audits cost money.

January 27, 2026 AT 01:27 AM

I work in a small rural hospital. We had a shortage of generic levothyroxine. We switched to another brand. Patient went into atrial fibrillation. Turned out the fillers were different. We didn’t know because no one told us. Now we check every batch. It’s a pain. But it’s safer. Just saying.